-

Investment Banking

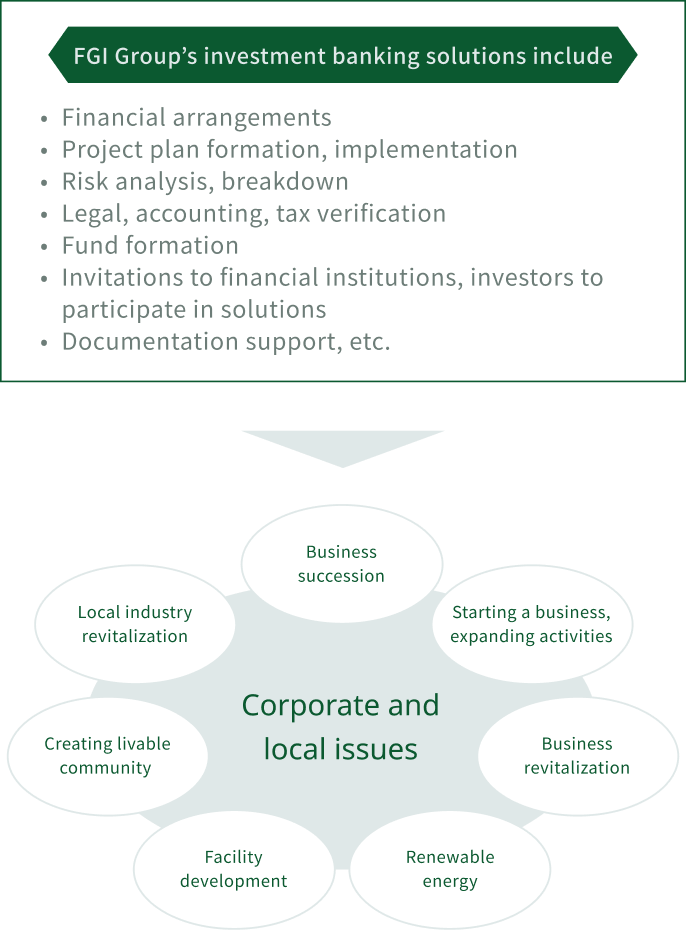

We support fund procurement efforts through financial arrangements and financial advisory services and help clients achieve their strategic goals.

Learn More -

Investment

We engage in principal investment to raise value by discovering latent value and future prospects in projects and structures in need of capital.

Learn More -

Asset Management

We undertake asset management on such targets as real estate and securities. In addition, we provide aircraft financing services such as aircraft technology services, asset management, remarketing of aircraft/engines, aircraft operating lease.

Learn More -

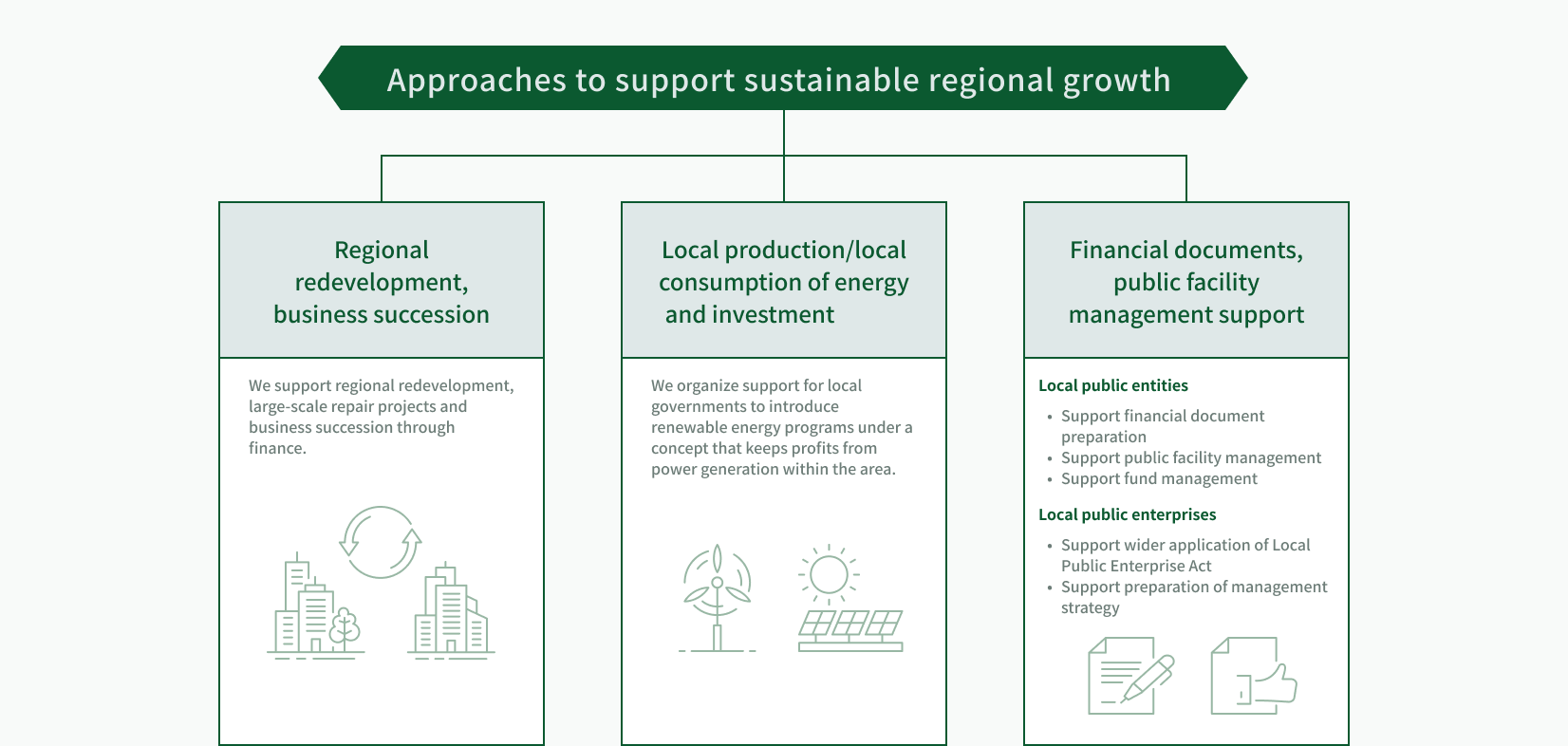

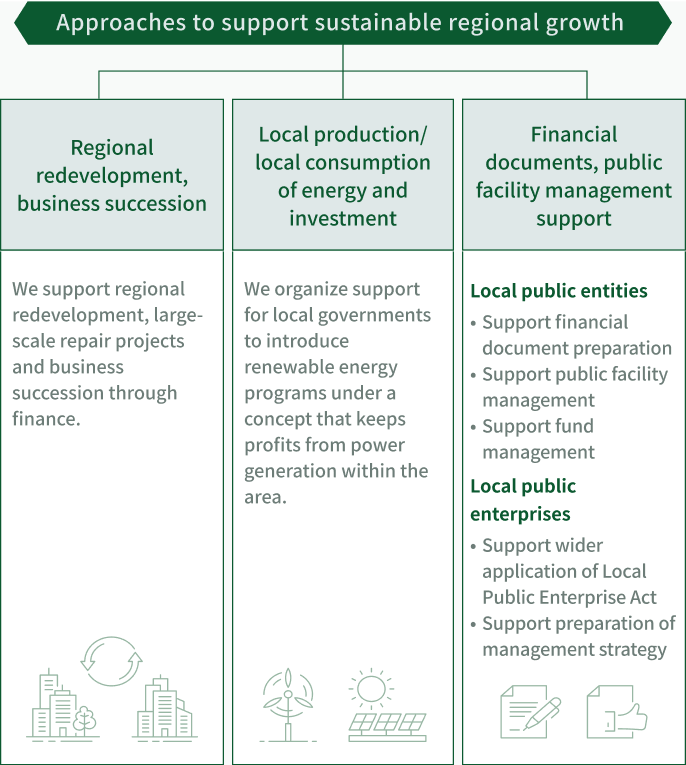

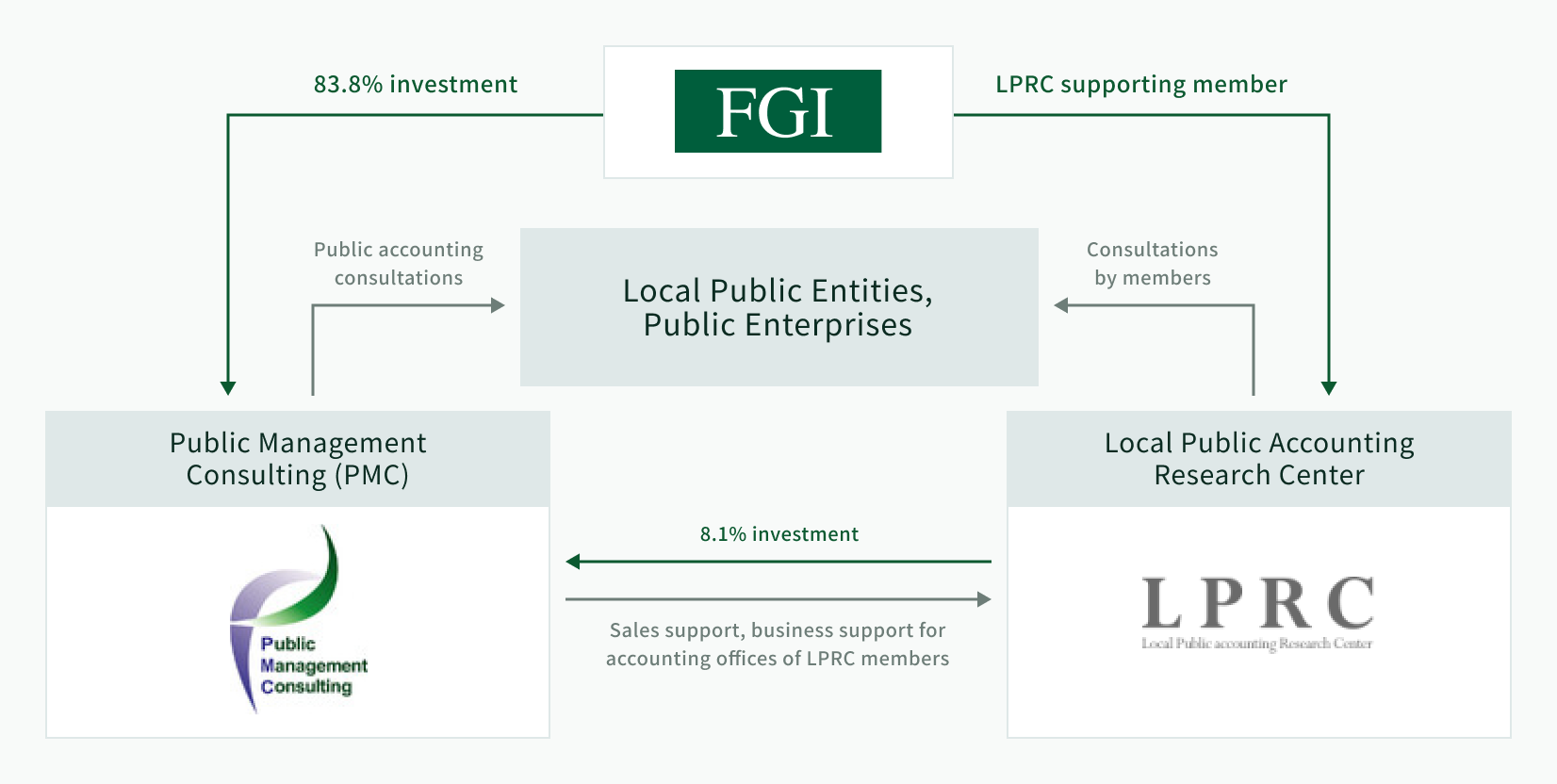

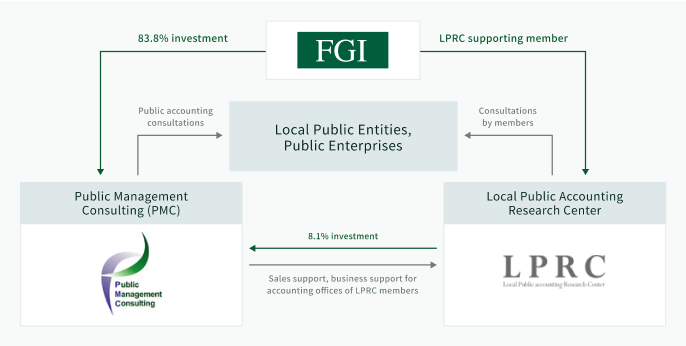

Local Issue Solutions

We help build sustainable communities through financial arrangements for redevelopment projects as well as public accounting and public facilities management support. Going forward, we will expand the scope of solutions to include support for the introduction of renewable energy and the creation of bases for regional revitalization.

Learn More

Investment Banking

Investment

On each project, we invest through private equity funds (nonconsolidated) formed specifically for that project through our own capital contribution as well as loans for financial institutions and other sources.

Related information

More details on MetsäAsset Management

Related information

FinTech Asset Management (FAM) corporate siteFGI Capital Partners (FGICP) corporate site

Related information

More details on aviation businessLocal Issue Solutions